WASHINGTON — U.S. Sens. John Thune (R-S.D.) and Catherine Cortez Masto (D-Nev.) today introduced the Mobile Workforce State Income Tax Simplification Act, bipartisan legislation that would simplify and standardize state income tax collection for employees who travel outside of their home state for temporary work. Under current law, individuals and employers face different state income tax reporting requirements in almost every state that vary based on length of stay, income earned, or both.

While some states require state income tax filing for as little as one day of work in the state, this legislation would establish a common-sense 30-day threshold to help ensure that an equitable tax is paid to the state and local jurisdiction where the work is being performed while alleviating burdensome tax requirements for employees and employers.

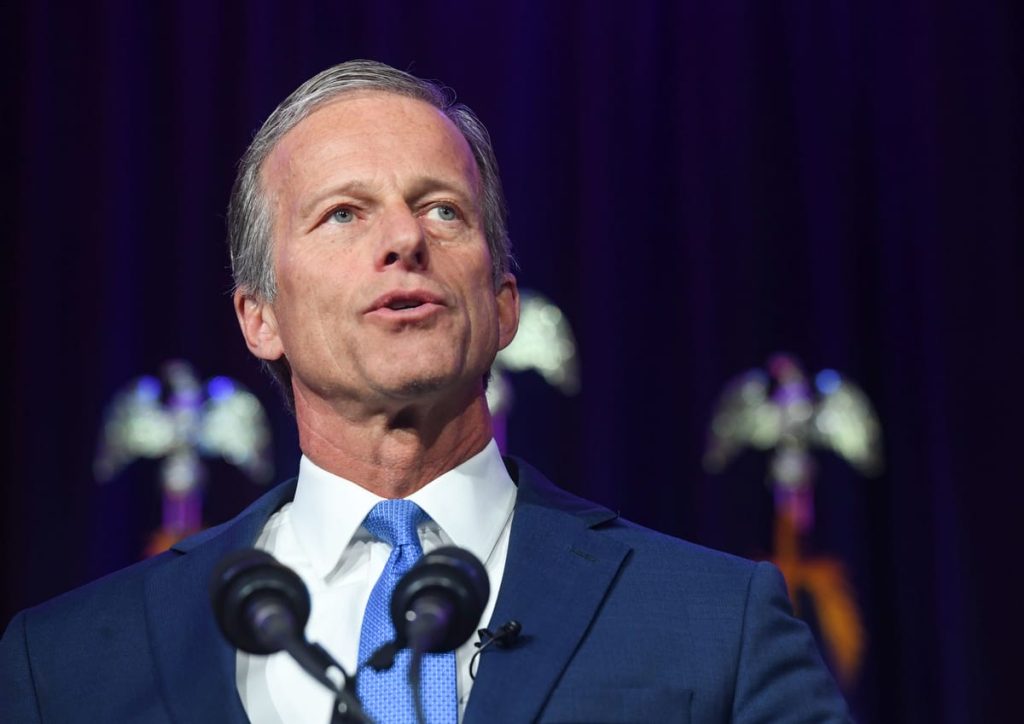

“It is complicated and unfair for an individual who lives in a state like South Dakota, with no state income tax, to have to file income taxes in multiple states for simply temporarily working in those states – in some cases, for as little as 24 hours – and not be able to recover any income tax payments he or she has to make,” said Thune. “The current framework is overly burdensome, and our legislation would provide much-needed relief by creating a common-sense, across-the-board standard for mobile employees who spend a short period of time during the year working across state lines.”

“Mobile workers who temporarily work outside of their home state should not find a surprise tax bill come April,” said Cortez Masto. “I’m proud to introduce this common-sense bill alongside Senator Thune to cut red tape and protect workers across the United States.”

“The Mobile Workforce State Income Tax Simplification Act offers much-needed clarity and consistency in state income tax obligations for remote and mobile workers,” said Tommy Pollema, executive director of the South Dakota CPA Society. “As CPAs, we support this legislation because it simplifies compliance for employers, reduces administrative burdens, and protects employees from undue taxation in states where they spend only a limited number of days. A uniform federal standard is essential in today’s flexible workforce landscape, ensuring fair treatment for taxpayers while supporting the business community with clearer, more predictable rules.”

“The Mobile Workforce Coalition applauds and enthusiastically supports Leader Thune and Senator Cortez Masto on their reintroduction of the Mobile Workforce State Income Tax Simplification Act of 2025,” said Maureen Riehl, executive director of the Mobile Workforce Coalition. “As an increasing number of companies and employees continue to be challenged by punitive nonresident state income tax rules, it is clear that a national 30-day standard legislative solution is necessary. Since its formation in 2011, the more than 300-member Mobile Workforce Coalition of diverse industries and organizations has advocated for uniform legislation at both the state and federal level, and this solution has enjoyed widespread bipartisan support in both chambers of Congress. The time is now for this to finally become law.”

“The U.S. Chamber of Commerce applauds Leader Thune and Senator Cortez Masto for reintroducing the Mobile Workforce State Income Tax Simplification Act, which would establish a uniform 30-day threshold for the application of state nonresident income tax withholding and information reporting requirements,” said Watson M. McLeish, senior vice president of tax policy at the U.S. Chamber of Commerce. “This long-sought, common-sense standard would simplify state tax jurisdiction questions and reduce compliance and reporting burdens on employers and employees alike.”

“The American Institute of Certified Public Accountants (AICPA) is pleased to endorse this bipartisan measure that achieves a reasonable balance between states’ rights to tax income and the needs of individuals and businesses to operate efficiently,” said Melanie Lauridsen, vice president of tax policy and advocacy at AICPA. “We are grateful to Senators Thune and Cortez Masto for their leadership on this issue. The AICPA endorses this legislation and urges other members of Congress to support American taxpayers and businesses by passing this bill.”

“On behalf of our corporate members, we are quite pleased to support Majority Leader Thune and Senator Cortez Masto in their efforts to reintroduce and enact the Mobile Workforce State Income Tax Simplification Act of 2025,” said Pat Reynolds, president and executive director of the Council on State Taxation (COST). “The legislation, which would simplify reporting requirements for traveling nonresident employees and their employers, is long overdue, and will bring much needed clarity to an area that fosters widespread confusion and noncompliance. Since 2019, COST has been actively pursuing similar legislation on a state-by-state basis, and a federal bill would greatly enhance and augment those ongoing efforts. We look forward to working with Senator Thune to reconstitute the broad coalition of interested parties needed to see this federal effort to fruition.”