South Dakota data shows extreme wealth concentration

*Editors Note: Second in a Two-Part Series

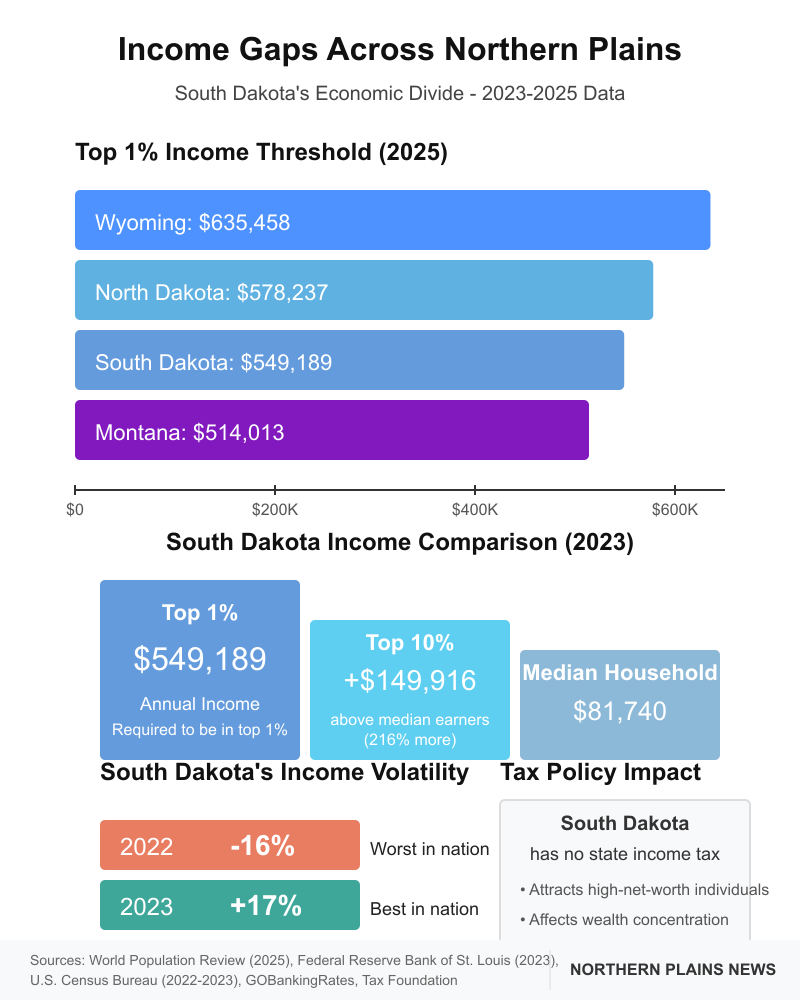

PIERRE, S.D. – Northern Plains states reveal stark economic contrasts in wealth concentration, with South Dakota demonstrating significant income gaps between top earners and median households, according to federal tax and census data.

South Dakotans need approximately $549,189 in annual income to reach the top 1% of earners in 2025, according to World Population Review’s analysis of IRS tax data. This places the state in the middle range nationally for top 1% income thresholds.

The Federal Reserve Bank of St. Louis reports South Dakota’s real median household income in 2023 was $81,740, ranking 22nd in the nation, showing the substantial gap between top earners and typical households.

High-Income Distribution and Volatility

South Dakota’s top 10% of earners make 216% more than median-income households, representing nearly $150,000 in additional annual income, according to GOBankingRates’ analysis of 2022 American Community Survey data published in December 2024.

“South Dakota’s top 10% is earning $149,916 more than its median earners, a spread of 216%,” the GOBankingRates report states, indicating a significant gap between top and middle earners.

South Dakota’s real median household income grew 17% in 2023, the best growth rate nationwide, according to Federal Reserve Bank of St. Louis data. However, the same dataset shows the state experienced a 16% decline in 2022, which was the nation’s worst that year.

Tax Policy Influences Wealth Distribution

South Dakota’s complete absence of state income tax creates distinctive financial incentives, according to the Tax Foundation’s 2025 State Income Tax Rates report published in April. Only eight other states, including neighboring Wyoming, also share this tax advantage.

“Nine states — Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming — do not have an income tax,” states the Tax Foundation report.

Economists studying regional tax policy impacts say these tax advantages attract high-net-worth individuals seeking financial advantages, potentially contributing to the state’s income distribution patterns.

Regional Comparisons Show Pattern

North Dakota’s top 1% threshold reaches $578,237, according to World Population Review’s 2025 data, slightly higher than South Dakota’s figure. The state saw a significant income shift recently, with real median household income declining by 6% in 2022, according to a September 2024 CNBC report.

Montana’s threshold for entering the top 1% sits at $514,013, while Wyoming requires $635,458 in annual income to reach the same percentile, according to World Population Review.

Wyoming’s income distribution is particularly notable because despite having high-income thresholds, it maintains “the third lowest level of income inequality in the country (as reflected in its GINI Coefficient),” according to GeoCurrents’ 2023 analysis of income distribution patterns.