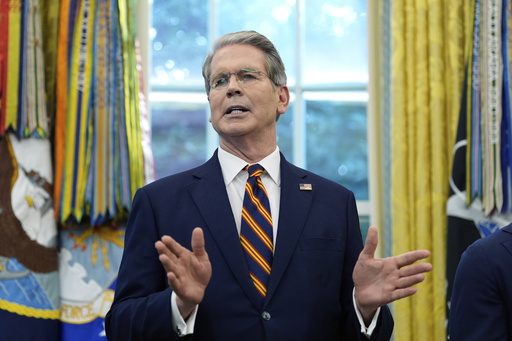

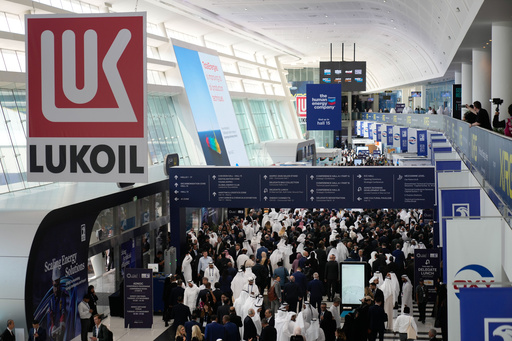

US sanctions on big Russian oil firms are having their intended effect, Treasury official says

The Trump administration says it’s seeing signs that its sanctions on Russian oil producers are working. Prices for Russian crude have plunged over the past few weeks, and Indian and Chinese buyers have moved to cancel or pause their purchases before Friday’s deadline to cut off business with Rosneft and Lukoil. That’s according to a senior Treasury Department official, who spoke to reporters on condition of anonymity. The sanctions aim to pressure Russian President Vladimir Putin into negotiations to end the war in Ukraine. They come as the Trump administration presents Ukraine with a new proposal that calls for major concessions.