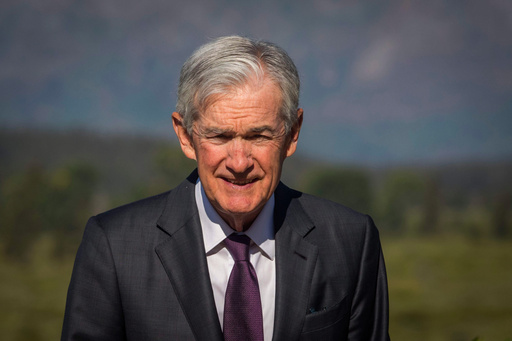

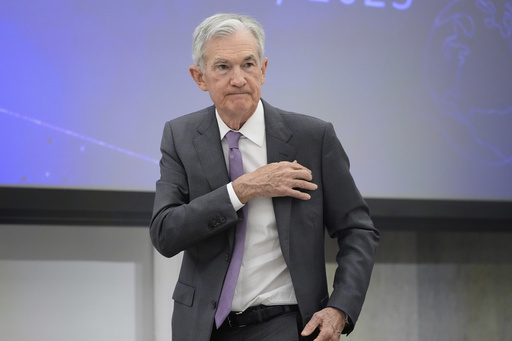

Slowdown in US hiring suggests economy still needs rate cuts, Fed’s Powell says

Federal Reserve Chair Jerome Powell says that a sharp slowdown in hiring poses a growing risk to the U.S. economy. Powell’s comments Tuesday suggest that the Fed will likely cut its key interest rate twice more this year. Powell said in written remarks that despite the federal government shutdown cutting off official economic data, “the outlook for employment and inflation does not appear to have changed much since our September meeting,” when the Fed reduced its key rate for the first time this year.