Farm income, sales tax collections, job openings, unemployment, personal income and gross domestic product are among the top concerns. ‘No red flags … (but) a return to more of the normal.’

So far in the post-pandemic period, the South Dakota economy is humming along nicely, though some new economic indicators reveal concerns that growth might slow in the coming months or years.

According to a recent financial forecast produced by the Governor’s Council of Economic Advisors, many data points show the state has been in a very strong financial position in regard to housing, employment, income and gross domestic production.

However, three economic experts asked by News Watch to review and analyze the state forecast said the almost unprecedented growth seen since the COVID-19 pandemic in 2020 appears to be tapering off.

“I’d say our economy has grown very strongly over the last three years, uncharacteristically strongly, and this year, we are seeing kind of a reversion to the mean, kind of a return to more of the normal, if you will,” said Jared McEntaffer, CEO of the Dakota Institute, a nonprofit group focused on analyzing and aiding the South Dakota economy.

New data points underscore challenges

Furthermore, the experts said a few indicators in the recent state report should be watched closely, as they carry potential warning signs for the future.

Chief among those concerning indicators:

- A somewhat stark drop in overall farm income since 2022 that can cause negative ripple effects across the entire state economy.

- Lower-than-expected state sales tax collections in June and July, which could portend a crisis if that trend continues – especially if voters decide in November to end the sales tax on consumable goods.

- The vast divide between the roughly 30,000 open jobs in the state and the 10,000 unemployed people in the workforce, which can stall business growth and productivity.

- The state’s 2% unemployment rate, which could lead to employers hoarding existing workers and preventing businesses from being able to expand or grow.

- A steady slide in growth rate in personal incomes since 2021.

- A slip in gross domestic product growth in 2024 that may be the result of other economic factors that are slowing growth overall in the state.

Despite those results, McEntaffer said that “there’s no red flags that I’m seeing that jump out to me and say, ‘Hey, we could be looking at a change in fortunes in South Dakota.’”

Here is an at-a-glance look at a few economic indicators that the economists highlighted in the Aug. 29, 2024, report.

Farm incomes fall from peak

According to the state report, overall farm income in South Dakota was around $700 million in 2006, then rose to $3.7 billion in 2011 before dropping to about $1.2 billion in 2016-17. When the pandemic hit in 2020, however, demand and commodity prices both rose sharply and as a result, so did farm income, reaching $3.7 billion in 2021 and peaking at $4.4 billion in 2022.

Since then, however, prices have come down and overall farm income fell as well, to $3.8 billion in 2023, with prices for corn and soybeans continuing to decline in 2024. Spending on farm equipment also dipped in 2023, the state report showed.

Joe Santos, a macro economics professor at South Dakota State University, said commodity prices paid to state farmers rose sharply during the COVID-19 pandemic and when war broke out in Ukraine, due to the loss of production of grain in Ukraine and the initial disruption of supply lines that drove up demand.

“Obviously, we don’t want to see a pandemic, and we’d love to see peace in Ukraine,” he said. “But without those pressures, prices will sort of ease. And while they won’t go into the toilet, they won’t be where they were when you had a pandemic and the belligerent activity that drove up commodity prices.”

The dip in farm incomes and the resulting negative outcomes statewide are good examples of how the South Dakota economy is often tied to external forces and events, Santos said.

“I think the way you’re going to see sluggishness in terms of economic activity in the state is probably going to be imported, in that the economic activity of this state reflects activity outside the state,” Santos said. “I think that’s probably our greatest vulnerability in South Dakota, in the state’s sensitivity to economic activity outside the state.”

Pluses and minuses of low unemployment

South Dakota is in an unusual position when it comes to its employment picture.

According to state data, non-farm employment growth has risen sharply since hitting a 12-year low point during the height of the pandemic in 2020, when the state had about 350,000 people working. Since then, non-farm employment has risen to about 470,000 people working.

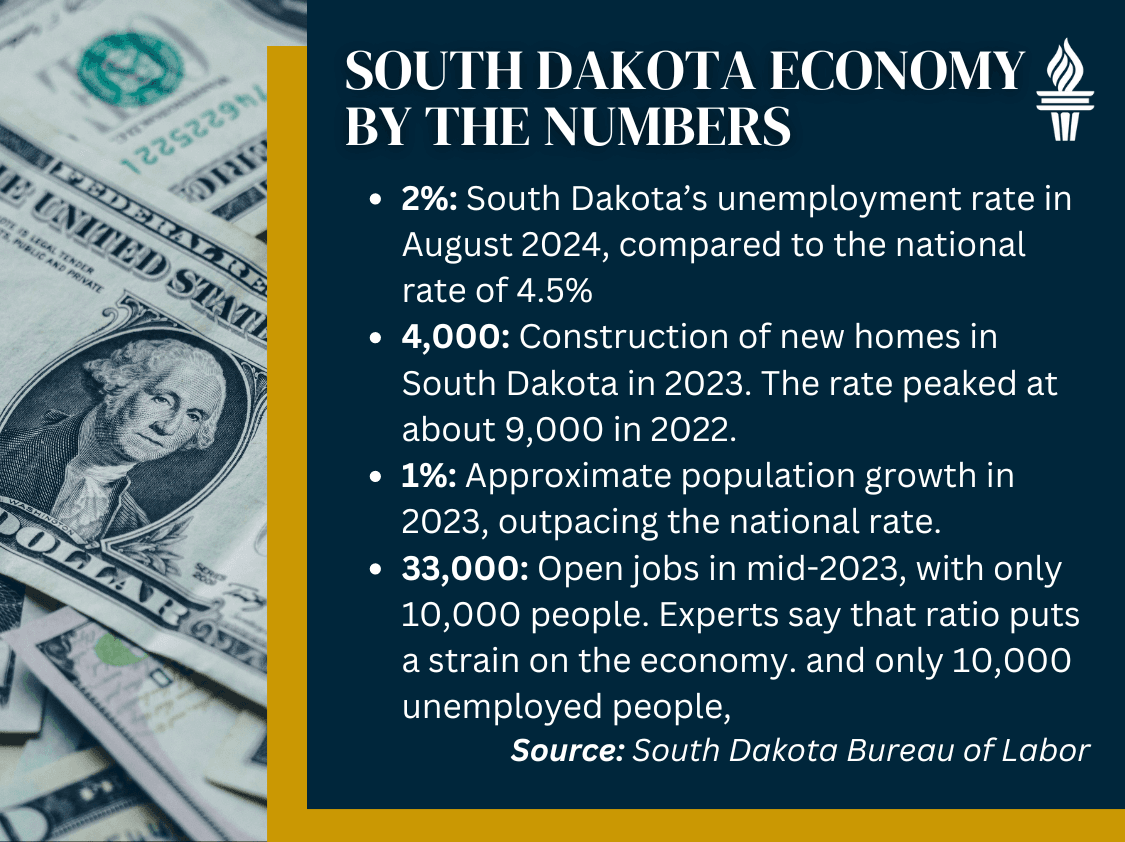

Meanwhile, the unemployment rate in South Dakota, which was about 3.5% in 2014 and which rose to 8.5% during the pandemic, has now fallen to around 2%, according to state data. The national unemployment rate has followed a similar pattern, jumping to more than 14% in 2020 and now hovering around 4.5%.

All three economists interviewed by News Watch pointed to the low unemployment rate as a problem, though generally a good problem to have.

Santos called the low unemployment rate a “second-order problem” that is less impactful than high unemployment, which would make it hard for people who want to work to find jobs.

But Santos also said an unemployment rate of 2% or lower could create a soft spot in the state economy.

“I think the downside is that the economic activity in the state is constrained by its inability to attract workers,” Santos said.

David Chicoine, a former president and economics professor at South Dakota State University, said economists across the country are trying to determine what level of unemployment is acceptable to sustain larger economic growth.

“The question that has come up since COVID and since the Great Recession, is what is the appropriate level of unemployment to have a robust economy?” he said. “Clearly, 2% is, in most people’s view, too low because that means you don’t have enough workers to take advantage of new opportunities and sustain long-term growth.”

Worker shortage a concern

The other, somewhat related, concerning data point is that the state had about 33,000 open jobs in mid-2023 and only 10,000 unemployed people, which Chicoine said can stunt productivity and growth in the business sector.

That gap exists even as the state has seen population growth of 1.5% in 2022 and more than 1% in 2023, both rates that outpaced national growth.

“I still think the economy is going to grow, but at what pace?” he said. “If you’ve got more jobs than you have people, that’s going to put a constraint on the ability to grow because you’re just not going to be able to have the output of a stronger labor force.”

Get free, in-depth news every few days. Unsubscribe anytime.

* indicates requiredEmail Address *First NameLast NameZIP Code

McEntaffer said the lack of workforce is largely due to the geography and demographics of South Dakota, which is a rural, low population state compared to other states.

Other than increasing innovation or raising productivity of individual workers, the only way to fill open jobs is to attract more people to the state, he said.

“It is putting restrictions for businesses and consumers,” McEntaffer said. “We’re right to do what we can to attract people. It’s a strong economy, it’s a great place to live and all of that, and if we can get more people here, that will help alleviate some of those strains on the economy.”

General fund revenues

After two years of consistently steady growth in revenues, buoyed by billions in federal government stimulus money given to the state and local governments, businesses and individuals, revenue growth slowed in June.

In July, the state experienced a decline in revenues compared to legislative estimates. The June data shows an increase of just 0.4% over legislative estimates, and July saw a 3.7% negative growth figure, with a $9 million shortfall compared to legislative projections.

Chicoine said the recent slowdown is not a major concern unless the trend continues.

“If we flatten out for the rest of the year, and we’re already down in the first month of the new fiscal year (July), we won’t know the full magnitude of any decline until we get there,” Chicoine said. “The negative growth that we saw suggests the downward trend could continue and accelerate.”

Housing prices and construction

South Dakota followed the national housing market fairly closely in recent years, especially in growth rate of home construction and prices.

The home price indices, a broad measure of average home sale and resale prices, rose slowly in South Dakota and the U.S. from 2012 to 2021, then showed a significant price jump over the past three years.

Construction of new homes in South Dakota dipped to about 3,000 in 2019, then peaked at about 9,000 in 2022 and came down to about 4,000 in 2023 with a slight uptick since.

Santos said he believes the Federal Reserve Board has taken appropriate steps in regard to managing lending rates to reduce inflation and stave off a possible recession in the U.S. and in South Dakota.

Rising interest rates in recent years, followed by the recent lowering of rates, was appropriate, he said. The lower rates should now stimulate more residential and commercial development and sales activity that will bolster the overall economies of the state and nation, Santos said.

In their final analysis, all three economists said they see a positive economic future for South Dakota.

Santos said he expects the state to continue to benefit from government policies that generally tend to be pro-business and pro-growth.

“There is a kind of a deregulatory, pro-free enterprise mindset in the state, and I suspect that’s a tailwind, not headwind,” he said. “There is a kind of a business-first orientation that if we have issues, let’s see if the private sector can deal with them first.”